Holy Shit.

As we predicted from the last time we checked in, Bitcoin would have an epic year in 2021 but we didn’t expect Bitcoin would reach $50k+ this goddamn fast!

Lots of people have been hitting us up on what the fuck is going on with Bitcoin and why the hell is this shit pumping like crazy! 😝 😝 😝

It’s the Institutions. They are driving this new cycle til the wheels fall off!

So Peep…..

Institutions are holdin 3% of that circulating supply

24 major institutions have collected over 450,000 in Bitcoin

5% of CFOs plan on buying Bitcoin in 2021.

A few reasons it’s poppin right now

1. The growing acceptance of the narrative that BTC is Gold 2.0 (Digital Gold)

2. Market infrastructure is more mature since 2017. The market now has an institutional custodian and crypto prime brokerage services.

3. The last Bitcoins will not be minted until 2140. However, out of the 21 million that will be created, there are only 2.5 million left to be mined. So if you are a company that is trying to grab a large bag of Bitcoin, you are running out of time. This means supply shortage, which in return builds demand. The 2020 Bitcoin Halving did this.

In particular, MicroStrategy. Institutional interest in Bitcoin went way up since MicroStrategy (MSTR)/CEO Michael Saylor copped 70,469 Bitcoin at an estimated cost of $1.125B with an average of $15,964 per coin in 2020.

Michael Saylor can do as he damn well pleases because he owns most of MicroStrategy’s class B convertible common stock, which has 10 votes per share versus one vote per share for each holder of class A common stock.

The company’s 2020 10-K filing let you know: “Accordingly, Mr. Saylor can control MicroStrategy through his ability to determine the outcome of elections of our directors, amend our certificate of incorporation and by-laws, and take other actions requiring the vote or consent of stockholders, including mergers, going-private transactions, and other extraordinary transactions and their terms.” BOOM BAM.

🌛We are riding w Saylor!

MSTR’s Bitcoin stash more than doubled from $1.1B to $3.4B - GOOD GAWWWD. 😳

MSTR owns more BTC than any other operating company. #FACTS

MSTR’s “Bitcoin Acquisition Strategy” basically lets you know they have no plans to stop buying up Bitcoin. They will use excess cash flows and debt to get more and more of it. It’s literally a part of their business strategy. So Lit! 🔥 🔥 🔥 🔥 🔥

Just Yesterday…..

MicroStrategy is about to flip another $900 million stack with an additional option for $150 million more depending on demand with 0% interest.

They are basically making a clean-ass bet on the increased value of MicroStrategy’s Bitcoin holdings.

It’s chess, bitch.

If the $1 billion or so of the proceeds go to copping more BTC, at current prices MicroStrategy would get another 19,230 Bitcoin, bringing the secured bag to 90,310, or $4.7 billion. Oh weeeee!

And just like that…..

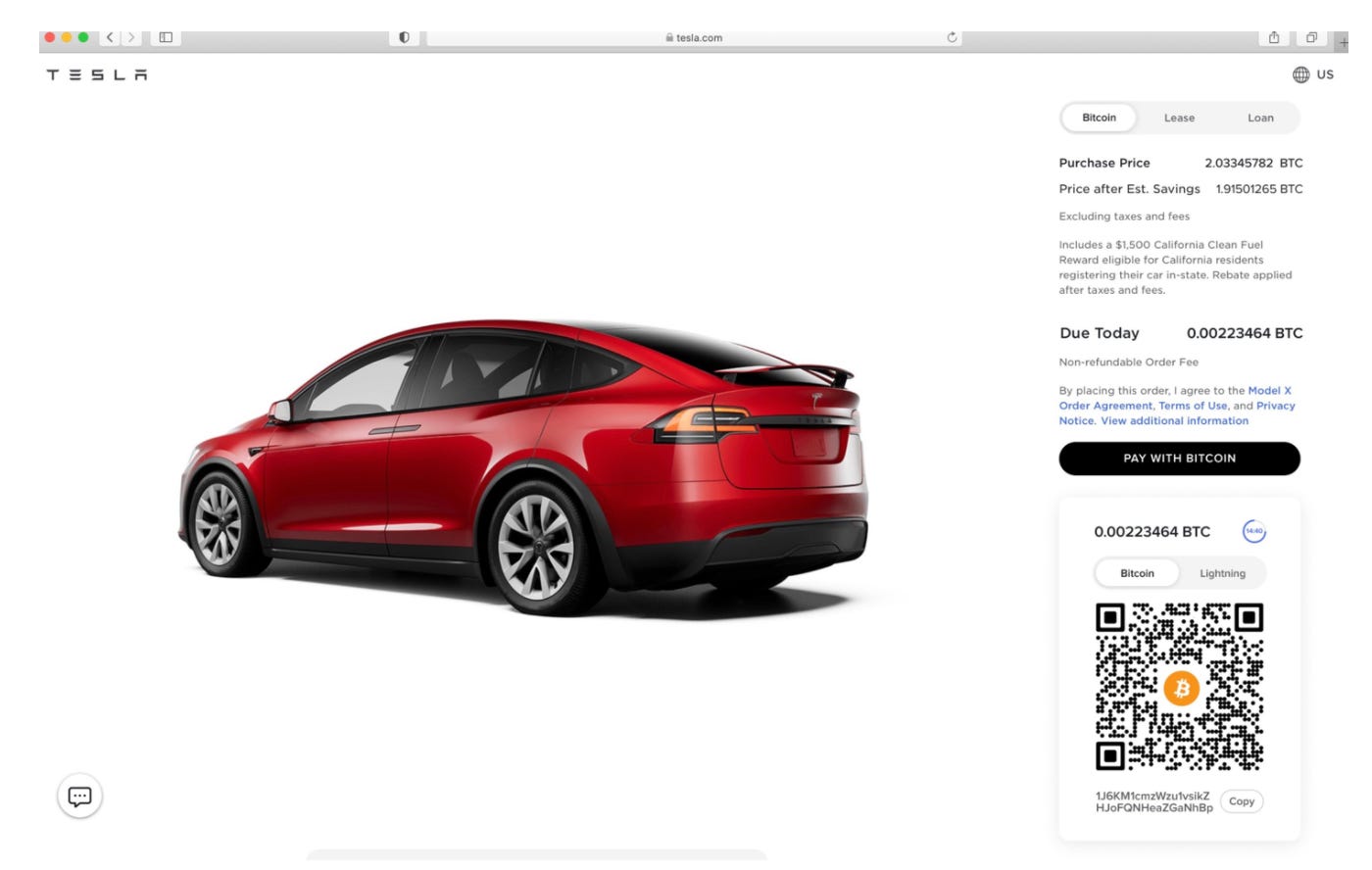

Tesla comes through with the $1.5 billion dollar buy of Bitcoin @ $38k per coin. In addition, they will eventually accept BTC for Telsa cars too! 🎯

And How’s it going?

Tesla has already made $725 million + off the Bitcoin bag. That amount is roughly what they made in profit selling whips 🚗 last year.

We may see over half of the S&P 500 adopting bitcoin as a long-term Treasury Reserve Asset.

We think some of the illest companies with healthy balance sheets looking to get it popping around their brand or stonk could use the MSTR Bitcoin play.

And why not? It worked for MicroStrategy after going through years of low sales despite the message its stock has been sending.

The message is clear.

Bitcoin can make your brand pop!

Bitcoin can make you bands.💰

Food for thought

Is this the opportunity for us to place bets on companies that are likely to flip their balance sheets with bitcoin? 🤔 NUMBER GO UP!

{credit Anil}

Thanks for reading! If you know ppl who would love this type of info, please share or just sign them up! ❤️

Nahrabbits created The Pager to communicate a mix of frequent messages to people about the not so obvious shit going down in tech and cool finance

Giving you that real since 2019.