🌸 The Wild 2020 Issue -#2

Us, looking at 2020 like.

What’s Up, Fam!

It was one hella of a ride in 2019, especially for those who sat on their Tesla stocks topping out at $430 per share. Goddamn! #bagsecured.

In the spirit of that wild ride, we decided to go with an amazonish jungle type design that represented the market over the last ten years!

In this edition, we are breaking down a couple of reasons why we decided to invest in a few particular stocks, and we highlight our prediction for a digital asset that may go HAM in the upcoming months. We also included a new section that allows us to share what we think is dope and overlooked on the internetz.

There is a lot to unpack and think about from this issue so take your time with it.

Let's Go!

-NahRabbits 🐰

The chart below illustrates the current bull market that started in March 2009 -2019. It is the longest bull market in history. 🤯 #MakingMoneyMoves

1. Tesla $451 per share.

Telsa is disrupting Transportation and Energy Sectors - both sectors are worth Trillions.

3 Words: Tesla crushed it.

Telsa’s stocks increased by 89%. In. three. months.

"I just drove the Tesla with both eyes closed"

- 2 Chainz

Delivered 367,500 new whips in 2019

250k+ pre orders for the Cyber Truck. Over $25 Million banked on a car that is not released.

Made Bank $$$$

Of course rappers are on the Cybertruck super hard.

Travis Scott managed to get his ass in our truck for the JackBoys video, first.

Ya, we are slightly hatin. lol

🔥The video is a GO. Check it out after your done reading this issue.

1. Gigafactories and Batteries

Musk's Gigafactories are the most essential assets that Tesla creates. The 1.9 million-square-foot factory in Sparks, Nevada, is only 30 percent complete or so. Still, it’s already on track to make 60 percent of the world’s lithium-ion low-cost batteries for electric whips only — and Tesla is building more Gigafactories around the world.

2. Artificial intelligence

Tesla is making artificial intelligence chips for autonomous vehicles. Last spring, Tesla showed up and showed out with an A.I. chip built with self-driving and redundancy capabilities. Tesla's AI chip is nearly four years ahead of anything that Nvidia can put in rides today.

3. Autonomous driving data

Ghostride the whip 👻

Tesla has around 10 to 12 billion miles worth of real-world driving data, whereas Waymo has a lot of simulated data. The big difference between the companies is Tesla prioritizes real-world data, while Waymo uses simulations to evolve its self-driving technology.

*The Bonus

Telsa has love for the puppies.

Peep, Tesla owners can leave their pitbulls, or doodles in the whip, locked down, with the AC blasting, and a message will pop up on the touchscreen saying "my owner will be back soon so chill the fuck out" and features the temp within the ride, to let all the nosey folks know that your dog is safe (and you don’t have to worry about getting side-eye 👀…).

“Lost some of my hottest verses down in Cabo,

So if you find a Blackberry with the side scroll

Sell that muthaf*cka to any rapper that I know “-Drake

2. Blackberry $6.71 per share

Oh Shit. Yup, Blackberry. 🍇 ( yup, and we used the grape emoji too)

Blackberry is the stock pick we hinted at in our last post before the new year of 2020. Also, if you were paying attention, we sprinkled some blackberry phones in the Xmas artwork, but we know you'll glanced over it. Ha!

So why in the hell would we pick Blackberry?!

One Word: Cybersecurity.

Yes, The Blackberry phone with the side scroll, Drake used to thumb write all of his raps for the platinum-selling debut album "So Far Gone" has made a complete pivot from selling phones to selling Cybersecurity software to companies & governments.

“You use to call me on my cell phone”-😢

Some Drip 💧

1.BlackBerry is no longer a phone company.

2.BlackBerry now only makes software.

3.BlackBerry’s focus is on offering cybersecurity software systems for autonomous vehicles, and the Internet of Things endpoints.

If you can't beat them, BUY THEM. That's what Google and Microsoft do all the time.

Back in early Feb of 2019, BlackBerry splurged heavy on an AI-powered cybersecurity startup called Cylance, for $1.4 billion. The reason being, Cylance is an AI-powered endpoint protection platform designed to prevent advanced threats such as malware and ransomware.

"The deal was all about securing endpoints for enterprise customers and was explicitly designed to boost BlackBerry’s enterprise-focused IoT platform Spark and its UEM and QNX products."

With this smart acquisition, it helped BlackBerry make a sound move to become “the world’s largest and most trusted AI-cybersecurity company. Boom. 💣

More of that Drip 💧

The Government is feeling the Blackberry Gang.

On the last earnings call, Chen ( CEO of Blackberry) spilled some hot tea about their involvement with NSA ( National Security Agency).

And What'd he say?

So basically…Blackberry partnered with CACI International to provide certified phone communication apps using BlackBerry’s secure voice and text technology. The target market will be for over 4 million US government-issued cellies 📱. In addition to that, he revealed Blackberry's software meets the NSA’s strict program requirements, and it’s the only software solution of its kind in the FedRAMP certification.

Another Banger. 💣

The opportunity

People are seriously sleeping on Blackberry’s latest move. The global cybersecurity market was valued at USD 118.78 billion in 2018 and is expected to reach $267.73 billion by 2024. That's a lot of bread on the table to be captured by Blackberry, hopefully.

We believe the strongest thing that Chen (CEO of Blackberry) has is sound strategic management and brand awareness.

Everyone is already familiar with the brand Blackberry.

This is that sleeper stock that no one sees coming. Lots of folks think Blackberry is a washed-up brand. It’s not. That way of thinking on their side is where the opportunity lies for us. We have been loading up @ $5 and up per share. We are super long on the company so we expect good quarters and bad ones. We are not tripping off of short term pullbacks. We will hold this stock for 10 years at least.

Fact on Facts on Facts…

Blackberry stock use to be $148 per share back in the Obama years. It dropped to $5 bucks and some change after Apple came in and ate its lunch with the iphone product.

The stock is sitting at $6.71 right now. It can be swooped up easily on Robinhood via phone app 📱.

One More Thing

Also, how Blackberry got taken out by Apple is a lesson to study within itself too! We might explore that from our angle in the future.

Do Your Own Research before you cop a bag a Blackberries tho.

Secure The Bag.

We are keeping this one short. Just be ready for next cycle. This is where we are at mentally on our Bitcoin bags. Everyone is waiting for the biggest event in Bitcoin, which is the Halving.

Bitcoin Halving is in 126 days.

Reward-Drop ETA date: 13 May 2020

Our Prediction: Dec 2020 $10,000 - $13,000 per coin.

Our Prediction: Dec 2021 $50,000- $100,000 per coin.

Done.

Some dope shit we found out about that we want to share with you.

1. 📚NoName's Book Club

Bruh, Chicago rapper, NoName is different. We always love to see how folks will use their platform to push the culture forward. She is doing it.

NoName has set up a Book Club for People of Color. Woah!

Each month, the book club highlights two books written by melaninated authors. The club has 6 local chapters with plans for expansion. This idea will catch on eventually with other household names but we hope in a sincere way.

Here is the About Page to see how it's all going down: https://www.nonamebooks.com/about

Trend forming: Niche based communities coming together in real life to chop it up about interests and purpose.

What is an interest that you could share with another person to build on with?

2. Walt Disney was kinda cray-cray. 🤯

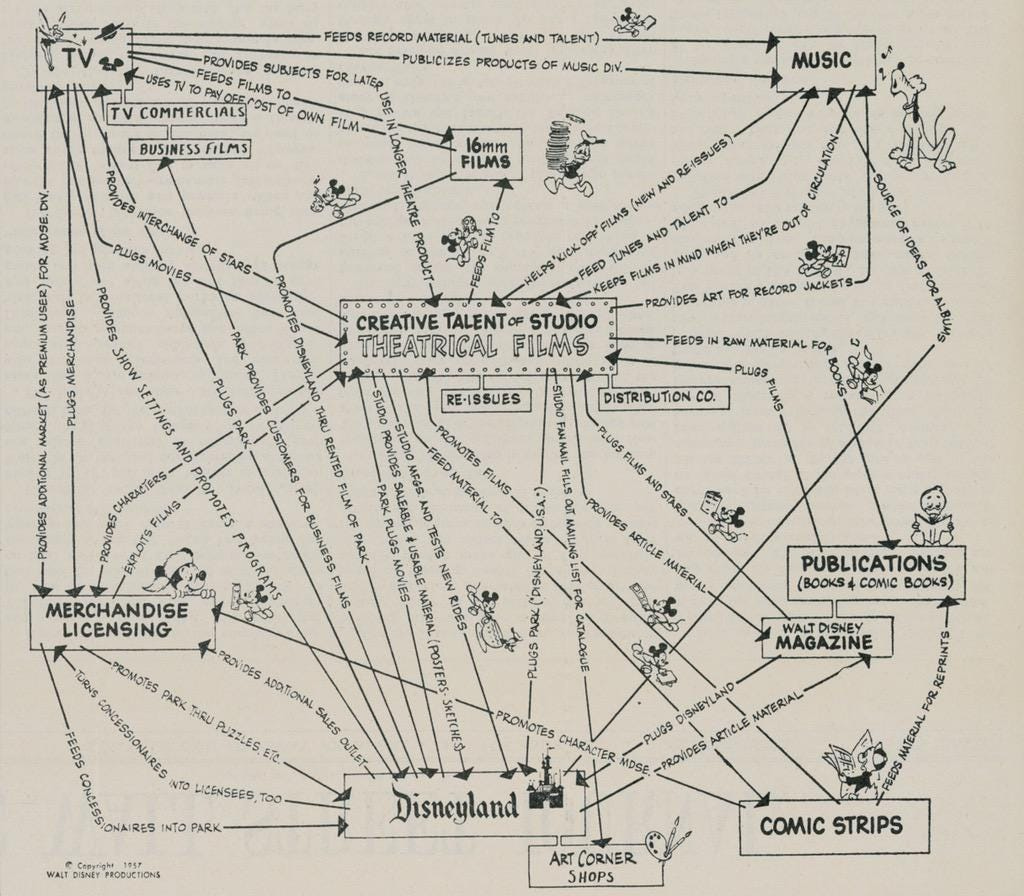

So this 1957 drawing below reveals the crazy lit strategy behind Disney's lasting TURN-UP! 1957, fam! That is 63 years ago.

Peep this drawing he did. Everything is connected and everything promotes another product. This is literally “the Blue Print” like Jay Z. If you are thinking about creating a business or have one now, take this, study it, and apply it.

A lot of us wish we had some shit mapped out for us, well here you go.

Study This.

“The image depicts Disney's core business as grounded in films, with a portfolio of entertainment assets that are supported by and also reinforce the movies.” Biz Insider

For example, raw content from the movies were pass over to Disney's publications hubs, which in turn did direct advertising for Disney's movies and theme parks. Meanwhile, the parks provided a sales outlet for Disney merchandise.

Sourced From: From Business Insider.

#Brilliant.

Another Fact:

We wrote and designed this Issue #2 while listening to Griselda’s “ Cruiser Weight Coke”.

On Repeat. ❤️ the drums and organ on this.

And another last last Fact: We were on Griselda before Drake mentioned them in his Rap Radar interview last Dec 2019- FYI.

Next Issue will come in a week or so.

Thank you for reading! Please subscribe and share our newsletters if you are digging the vibe we just provided you.

NHR Team.